Taking the Friendly Out of Fraud

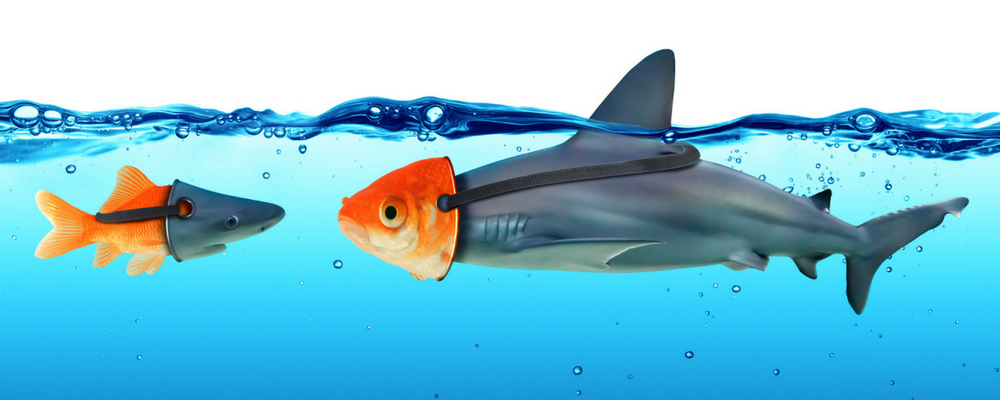

Let’s get straight to the core of the matter and state it outright: there is nothing friendly about friendly fraud. Friendly fraud is fraud—plain and simple. Yes, there are customers who make mistakes and inadvertently file an invalid chargeback, but this is the exception and not the rule.

The term friendly fraud came from within the payments industry as a way to categorize customers who file chargebacks, either to commit theft or as a result of billing confusion. The roots of this term are found in the history of chargebacks, which were introduced as a form of customer protection from credit card fraud and theft.

The system that was put in place to protect consumers from credit card security risks and theft is now being manipulated to commit chargeback fraud. There is definitely nothing friendly about chargeback fraud and the impacts it has on your business.

Types of Friendly Fraud

One of the biggest challenges facing merchants, banks, and issuers is fighting friendly fraud. Because the chargeback system is designed to favor the customer, the representment and dispute process can make it very challenging for merchants to defend themselves in fraud cases.

Savvy fraudsters have learned that some methods to defraud legitimate businesses are easier than others. Be aware of these fraud schemes and shady customer claims:

- The order was never delivered

- The product or service doesn’t match the description on the website

- Customer claims they returned the item and haven’t been refunded

- Customer canceled the order but the item was still delivered

- Customer already filed a chargeback, which you’ve paid, but the customer insists they received no funds

Your protection mechanism against friendly fraud depends on you having easy and efficient access to all the transaction data needed to debunk the friendly fraud tactics of confused or unscrupulous customers.

Preventing Friendly Fraud

Just as brick-and-mortar merchants have solutions in place to prevent theft, you need to do the same for your e-commerce business.

When reviewing your website, customer service team, payment processing solution, record-keeping tactics, and customer analytics, make sure you’re doing the following:

- Refund/return policy: This should be clearly stated and accessible on your website and all customer communications. This is necessary information to successfully win a representment case. Many credit card companies have specific requirements on how and where your return/refund policy should be displayed, so make sure you’re complying with these directions.

- Shipping and delivery: Clearly state the shipping policy. Provide customers with the option to select the type of shipping that works for their needs. One of the best methods for your protection is to require a signature and receipt upon delivery of the product. This provides evidence that the item was delivered to the address entered, and it includes the specific time and date.

- Confirmation emails: Confirm the order and include all details of the order in email. Some merchants include an option in their confirmation email for their customers to cancel their order within a specific number of days. This extra step provides some assurance against customers who claim they didn’t know about the order or weren’t able to cancel it.

- Address confirmation: Be aware of orders that have different billing and shipping addresses. Confirm these addresses, and be extra vigilant with multiple orders from a customer using conflicting addresses.

- Billing descriptors: Ensure the billing descriptors that you provide for credit card statements are clear and include full details on items purchased, including the date and purchase method.

- Customer records: Retain copies of every single item of communication with customers. This customer data can serve as solid support during a chargeback dispute.

End-to-End Fraud Protection

Protecting your business from friendly fraud cannot be accomplished with half-measures. Along with the recommendations above, it’s advisable to consider implementing an end-to-end payment solution for your business.

For front-end protection of the transaction cycle, a solution that notifies you as soon as chargeback is filed provides you the opportunity to respond as quickly as possible.

Back-end protection enables you to prepare the appropriate response to a dispute and recover any profits that you might lose to friendly fraud, or from the result of chargebacks. For expert recovery of lost revenue, solutions from Chargebacks.com feature expert services to help protect your brand and increase your profits.

Despite the innocuous term, there is no such thing as friendly fraud. Fraud is theft. Be weary of savvy fraudsters—equip your business with the right tools and solutions to ensure you’re more than one step ahead of fraud.